News

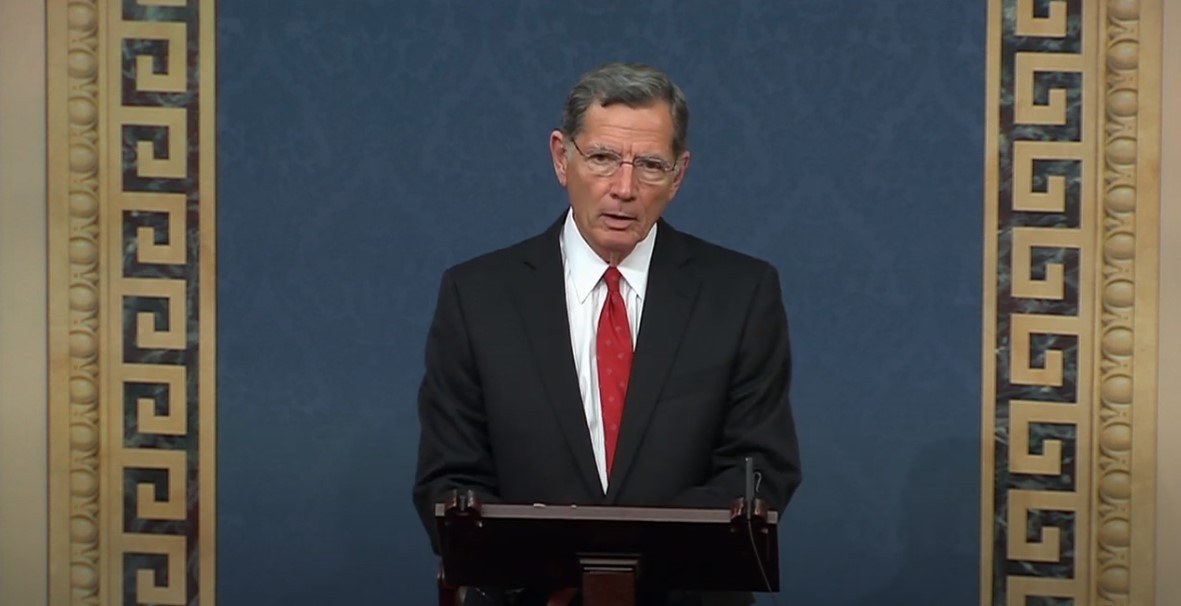

Senators Barrasso, Cardin Introduce Bipartisan Bill to Protect American Taxpayers

U.S. Senators John Barrasso (R-WY) and Ben Cardin (D-Md), both members of the Senate Finance Committee, introduced bipartisan legislation Thursday that is intended to give additional protection to taxpayers by providing more transparency from the Internal Revenue Service. Current law requires the IRS to notify taxpayers before contacting third parties – such as banks or employers – when investigating whether or not a person owes taxes, but does not require the IRS to disclose to taxpayers what specific information they are seeking. The Taxpayer Privacy and Notification Act would require the IRS to disclose exactly what information it is seeking from third parties and give taxpayers 45 days to provide that information directly to the IRS themselves.

Barrasso said Wyoming taxpayers shouldn’t have to worry about the IRS soliciting personal financial information behind their backs without first having an opportunity to provide it themselves. The Senator added that their bipartisan bill will safeguard the reputation of taxpayers and small business owners across the country and it will also force the IRS to be as transparent as possible when it comes to the privacy of hard working Americans.